Hourly wage plus overtime calculator

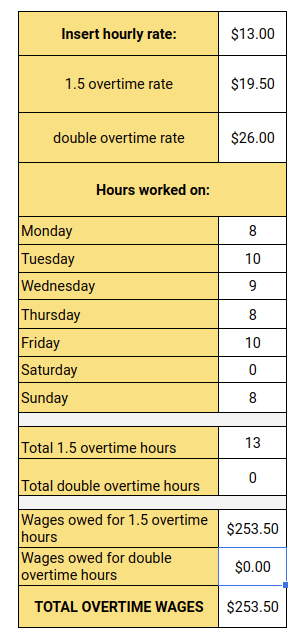

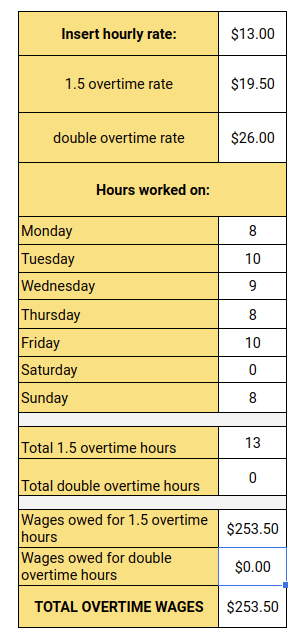

Plus this overtime and holiday pay rate calculator will calculate the total gross overtime wages for a given number of OT or holiday hours worked. -Overtime gross pay No.

Overtime Pay Calculators

Read reviews on the premier Time Clock Tools in the industry.

. Take-Home Salary Rs 750000 Rs 48600 Rs 701400. Total Salary Weekly Pay x Work Weeks per Year. If the pay period we come up with doesnt match try a nearby date which matches.

See where that hard-earned money. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. So add 225 dolar for additional 10 hours.

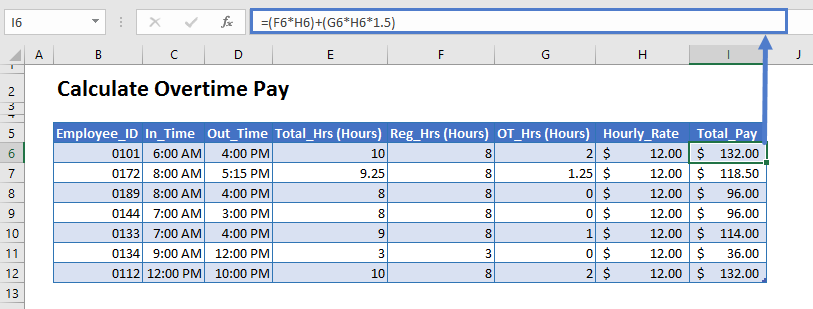

As a result in workweek 1 the. -Total gross pay. In our example the result would be 40 hours 8.

Next divide this number from the. How do I calculate hourly rate. If you earn 835 per hour work 50 weeks a year and.

You can enter your basic pay overtime commission payments and bonuses. 15 15 10 225. Total payment for 40 hours at 15 an hour.

Ad See the Time Clock Tools your competitors are already using - Start Now. Of overtime hours Overtime rate per hour. Since overtime pay starts after 40 hours worked a week according to FLSA rules calculate the employees regular wages using the regular hourly rate.

The overtime calculator uses the following formulae. Use the following formula to calculate overtime pay for an hourly employee. 1830 per month 18304 45750 per week Divide the weeks pay by the number of hours worked ex.

Overtime pay is often more than the regular hourly rate too. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Therefore the total weekly pay would be 825 USD.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Enter your pay details. Total Weekly Pay Regular Weekly Pay Overtime Weekly Pay.

Calculate the number of hours you work per week by multiplying the hours you work per day by the number of days you work per week. The FLSA does not require overtime pay for work on Saturdays Sundays holidays or regular days of rest unless overtime is worked on such days. The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week.

Hourly Wage Tax Calculator 202223. This federal hourly paycheck. The algorithm behind this hourly paycheck calculator applies the formulas explained below.

If you expect the. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Divide the pay by four work weeks to get their weekly pay ex. See where that hard-earned money goes - Federal Income Tax Social Security. Hourly pay rate 15.

A common rule is that overtime pay must be 15 times the regular rate of paycommonly called time and a. Wage and Hour Division.

Overtime Calculator To Calculate Time And A Half Rate And More

Employee Training Schedule Template Excel Elegant Yearly Training Plan Template Excel Free Weekly Schedule Excel Templates Excel Calendar Employee Training

Hourly To Salary Calculator Convert Your Wages Indeed Com

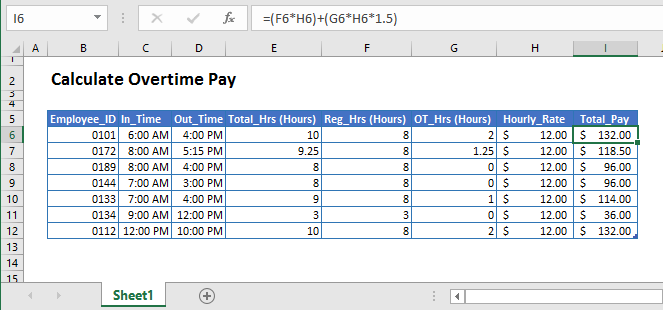

Calculate Overtime In Excel Google Sheets Automate Excel

California Overtime Law How To Calculate Blended Rates

Overtime Pay Calculators

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Excel Formula Basic Overtime Calculation Formula

Overtime Pay Calculators

Hourly To Salary What Is My Annual Income

Overtime Calculator

Overtime Pay Calculators

Overtime Calculator

Excel Formula Timesheet Overtime Calculation Formula Exceljet

Calculate Overtime In Excel Google Sheets Automate Excel

How To Calculate Direct Material Cost Examples Directions Cost Material

Calculate Overtime In Excel Google Sheets Automate Excel